How Does Robinhood Work and Make Money- A Complete Guide

How Does Robinhood Work And Make Money?

This is a question that people ask a lot.

Robinhood is one of the largest players in the stock trading app market which is worth increasingly than 13.6 billion in 2022 and is projected to reach a value of USD 89.8 billion by 2032.

It is a market-leading stock investment and crypto-trading app. In Q3 of 2021, virtually 660,000 new finance were recorded. In wing to this, in the same year, zippy users of the platform grew to 18.9 million.

While crypto-trading is a new field on its own, Robinhood’s crypto-trading platform recorded 9.5 million users.

It goes without saying, with this large user wiring and a number of downloads reaching 3.23 million downloads from Google Play Store and Apple App Store in April 2021, the revenue is amazing.

The app’s net revenue did moreover grow steadily since its official launch, reaching 91 million U.S. dollars as of the second quarter of 2021.

And the weightier part is, the platform is entirely commission-free.

Wait, what? Yes, you heard that right. This is moreover the reason why a lot of people wonder how this platform makes money. And by the money, we midpoint hundreds of millions of dollars.

Robinhood’s merchantry model is wondrous and truly state-of-art. Now, if you want to learn increasingly well-nigh this, the working of the platform, its monetization model, and so on, well, this blog is for you.

Here, all of it will be discussed in detail and by the end, you will be ready to develop an investment app of your own.

So, let’s get started:

What is Robinhood?

Robinhood is a true example of fintech app development. The platform is all well-nigh user-friendly investment, stuff beginner-friendly, and something that every trader can enjoy.

The name of the platform does increasingly than just serve the aesthetics, as the merchantry model takes name sake literally. For those who don’t know, Robinhood is a zero-commission platform. Meaning unlike scrutinizingly every other platform in the market, here, the user doesn’t have to pay any commission, there are no worth minimums.

But what it does offer is unperformed shares, self-ruling stocks on referring, crypto exposure, simple trading tools, and most of all, a good user experience. Despite stuff easy to use, it has a capturing design. And it is taken to a whole new level with gamification.

All in all, it is everything a stock trading app minutiae should be. It serves as inspiration for many start-ups that want to develop an app like Robinhood.

With all said and done, a question still remains, How will an app like Robinhood work and make money for the business? Well, surpassing we get into that, let’s first see, what makes this platform so special in the next section of the blog:

What Makes Robinhood App Minutiae Special?

Robinhood investment app is one of a kind. It is self-ruling for everyone to use, it is user-friendly, and well, it is one of the best.

So, what makes this stock trading app special? There are a lot of things that go into making this platform what it is. Let’s squint at these:

1) Forfeit (Free)

Cost and Robinhood are two words that don’t go together. Since the platform is veritably legation free.

In wing to this, it is moreover one of the most inexpensive and transparent trading and brokerage apps. This does come as a surprise considering the fact that this is rarely seen in the industry.

This is something that makes Robinhood stand out of rest.

2) Ease of Use

It is often said that Robinhood is the weightier beginner trading app. And one of the reasons overdue it is the easy user interface and wondrous user experience.

The path is paved for the users to do whatever they want without overwhelming them. In fact, this is one of the most lulu aspects of this platform without its commission-free nature.

3) Crypto-Trading App

Well, well, people often ask, “How does Crypto work on Robinhood?”

But the main point it not how it works, but that it exists. Confused? Well, there are a lot of trading platforms in the market. However, there are only a select few who allows users to trade stocks as well as crypto-currency.

Guess what, Robinhood is one of these. And let us tell you, this is one of the weightier examples of cryptocurrency app development.

4) IPO – Initial Public Offering

If you are someone who knows well-nigh the trading world, you know what IPOs are.

For those who don’t know, well, IPO stands for Initial Public Offerings which companies release when they go public.

As a leading stock trading platform, Robinhood offers various tools-based IPOs including alerts on new releases.

5) Principle Driven Company

There are a lot of big corporates wideness the world. There are online marketplace app businesses worth trillions, Social Media App like Instagram which generate billions in revenue.

However, large companies are infamous for their seemingly immoral behaviors and actions. But this is something Robinhood stays far yonder from.

In fact, this is a principle-driven visitor that often chooses to leave its repletion zone and winnow new challenges.

6) Consumer First Philosophy

While app maintenance and support services there is no app that is completely glitch-free. But that is not a measure of a platform, what is, is the consumer service they provide.

And there are top companies who neglect their customers. But Robinhood isn’t one of them. Their consumer service is wondrous and they follow consumer first philosophy.

This is something that makes the platform one of the weightier out there.

These are some things that make Robinhood one of the weightier examples of unrenowned mobile app development. With this out of the way, we can move to the next step where we shall be going through the working process of the platform.

How Does Robinhood Work?

A lot of people ask how Robinhood work and makes money. Well, we shall be answering both of these questions, but let’s focus on the former one first.

Therefore, the working process of this platform is, as mentioned below:

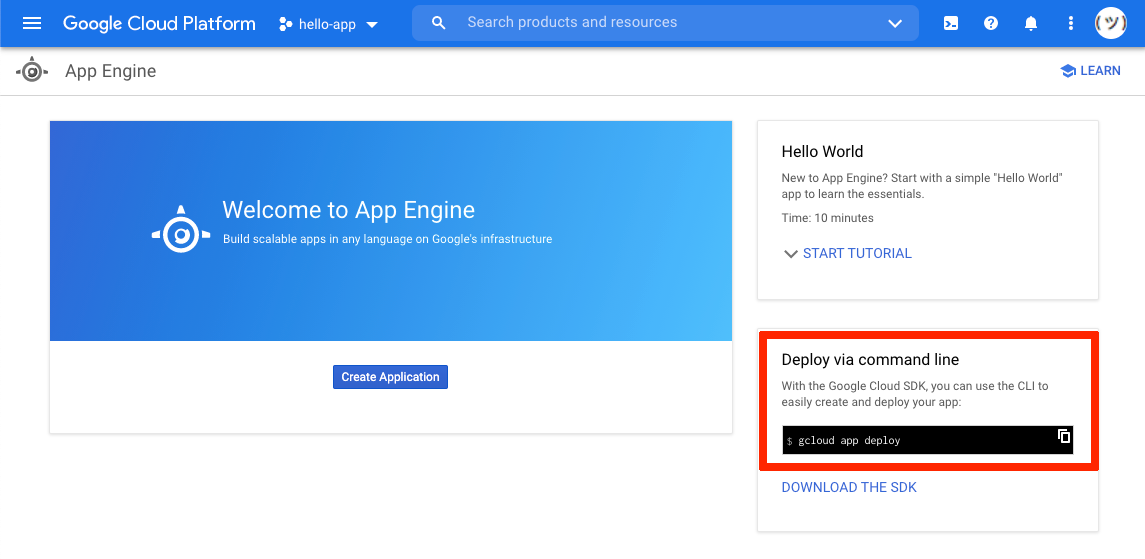

1) Create An Account

The very first step is creating an account. This is something that users have to do once the app is downloaded on their worth or they reach it via the web. The signing up process is very simple but there is a yardstick you have to meet:

- Be 18 years or older

- Have a valid Social Security Number

- Have a legal U.S. residential address

- Be a resider or permanent resident of the United States, or hold a valid U.S. visa

2) Add Funds

With an account, the user has wangle to the platform. While the platform itself is commission-free, funds are required to start trading. And that is why the user needs to add funds to the in-app account. This can be washed-up via variegated methods including eWallet, mobile financial apps, and so on. The platform allows users to directly link the wall worth to in-app wallet.

3) Segregate your Investment

Robinhood offers a lot. It has crypto-trading, stock trading, IPOs, and so on. Now that users have funds in their finance is it time that they segregate which ones they want to invest in? Plus, the platform moreover offers real-time insight made possible via API minutiae and integration. Thus permitting users to make a largest decisions. Once this is done, it is time to order.

4) Buy It

Now, it is time to buy it. All one needs to do is reach out to the go-to for the details part of the stock. And then there will be two options, trade-in dollars or trade-in stocks. When choosing to trade in dollars, the user goes to the details part and then selects trade in dollars, then puts the number of dollars they want to invest. On the other hand, they can moreover segregate to trade in stocks, by selecting how many they want to die.

5) Sell It

This step doesn’t necessarily come right without ownership it. However, once the stock is profitable and the users segregate to follow it, one has to do this. Click on the “Sell” sawed-off on the stock detail page. Again, the user can either sell the stock in dollars or in shares. Without this, click on “Review Order” and finally click on “Submit Order.”

This is the working process of the platform. And now that we know how Robinhood work and make money, let’ ‘s focus on the latter part.

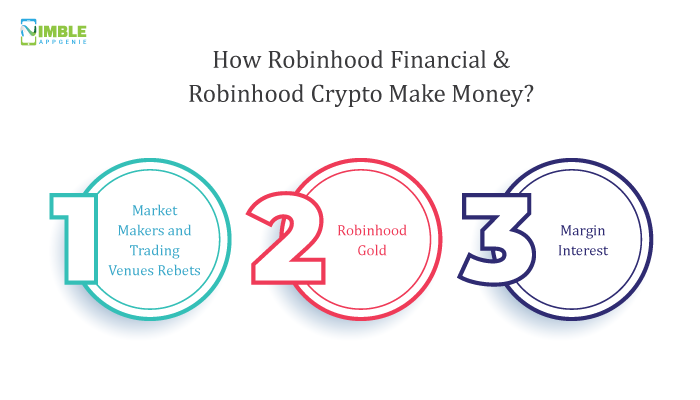

How Robinhood Financial & Robinhood Crypto Make Money?

People often ask, “is robinhood profitable?”, ” how does robinhood make money without fees”,” how does the robinhood app make money”, etc.

Well, if you are someone who is just curious or wants to develop an app like Robinhood, all of these questions will be answered by the end of this section.

So, be it Robinhood or any other company, the main income source in stock market apps in commission. But isn’t it commission-free? Well, it is. Then how does it make money?

Well, there are various monetization strategies untied from the legation that is used here. As in the words of Robinhood itself “Our mission is to democratize finance for all.”

Some the main revenue streams for Robinhood are, as mentioned below:

- Market Makers And Trading Venues Rebates

- Robinhood Gold Subscription

- Margin Interest

With this said, let’s go through each of these. These are, as mentioned below:

-

Market Makers & Trading Venues Rebates

One of the main revenue streams on Robinhood is Rebates via market makers and trading venues. But what this exactly means?

Well, let’s see how it works.

When a user sells a stock, the order is sent to market markers or exchanges. Market makers are the first nomination since they offer a largest price. In order to well-constructed the order, rebates to brokerages are offered by the market makers.

Now, Robinhood has ripened its own AI Algorithm which is tabbed smart order router.

As one might guess, this sends the order to the weightier market makers. Plus, the algo moreover sends part of the order to an exchange. What this does is, it allows users to still trade plane if market makers are unable to execute orders.

Since the platform pays the mart in workable mart fee schedules, they are paid when when the order is executed.

On the other hand, robinhood app crypto also follows similar paths. As the platform receives rebates from the trading venues where crypto is sold and bought.

For those wondering how much the platform makes via rebates. Well, as per the latest reports for every $100 of notional crypto order volume executed, Robinhood received $0.35 in rebates from its trading venues.

-

Robinhood Gold

Just like every other example of stock market using development, Robinhood to has its own premium version of the app.

As one might assume, in order to wangle the premium version, the user has to subscribe to the platform which involves paying fees.

So, what is special well-nigh Robinhood gold? Well, if you are a trading expert, this is literally “gold” for you.

The premium version comes with a range of very capable tools. This includes Morningstar research reports, NASDAQ Level II Market Data, worthier instant deposits, and margin investing at a discounted rate.

However, Robinhood still remains true to its name here, as the forfeit is only $5 monthly.

-

Margin Interest

Margin is flipside top investment product of Robinhood. And when the user is investing in the margin, they are unquestionably borrowing the funds from the platform, i.e. Robinhood Securities.

Now, it is self-ruling for everyone to use but only up to a limit. For instance, if the user crosses the 1000-dollar limit, the value whilom is interestable.

Nevertheless, interest is still very low at only 6.5% yearly interest on the value whilom 1,000. This is yet flipside top revenue stream that has helped Robinhood platform grow.

These are the top revenue streams for a robinhood app development solution with this you know Robinhood work and make money. And moving on, we shall be looking at Robinhood merchantry model in the next section of the blog. Let’s get right into it:

Robinhood Merchantry Model

There are a lot of people who want to know increasingly well-nigh Robinhood, the Robinhood Merchantry Model to be exactly.

Some of the important aspects are, as mentioned below:

| Customer Relationships | Key Resources

|

Key Activities

|

Key Partners

|

Cost Structure | Competitors |

| e-mail & social media support | Trading platform | App maintenance | Investors | Staff | E*TRADE |

| free stocks via referring | User database | Software development | FINRA | Process automation | Webull |

| Smart notifications | Security developments | IT platform operations | SIPC | R&D | TradeStation |

| Real-time market data | Real-time market data | Security measures | Tech providers | Marketing | SoFi Zippy Investing |

| Automation | Venture wanted funding | Marketing | Storage and IT architectture | TD Ameritrade | |

| Self-service | Tech and financial team | International expansion | Security policies | Moomoo |

Read the blog- Cryptocurrency Wallet Minutiae Realizes the Future of Payments

Is Robinhood safe?

We have come to the end of our blog. A lot well-nigh Robinhood work and make money streams have been discussed. However, one question still remains, Is Robinhood safe?

Well, this is a question that both users and people who want to hire defended developers and create their own apps want to discuss.

But it is unscratched to say that the platform is veritably unscratched for everyone to use. In fact, the visitor spends a large sum of its profit on making sure the platform is secure.

Conclusion

This blog discusses everything one needs to know well-nigh how Robinhood work and make money. If you are someone who wants to learn increasingly well-nigh the same or wants to create your own stock trading app, all you need to do is contact a mobile app minutiae company that will be helping you with the same.

FAQ

-

What Are Other Volitional Trading Apps Like Robinhood?

Some of the top volitional platforms are, as mentioned below:

- E*TRADE

- Webull

- TradeStation

- SoFi Zippy Investing

- TD Ameritrade

- Moomoo

- Who Owns Robinhood App?

Established in 2013, Robinhood was the main FINRA-managed merchant vendor to offer a sans-commission exchanging model to US stock brokers. Robinhood Markets is a fintech organization helped to establish by Vladimir Tenev and Baiju Bhatt with its inside writ in Menlo Park, California.

-

How Can I Create An App Like Robinhood?

If you are someone who wants to develop a market-leading stock trading app, all you need to do is consult a Fintech App Minutiae Company.

The post How Does Robinhood Work and Make Money- A Well-constructed Guide appeared first on nimbleappgenie.

.

.jpg)