10 Simple Steps to Launch an Insurance App

If you are an Insurance Company, You Should Develop and Launch an Insurance App, TODAY!

Why?

Here’s why: The insurance industry in terms of revenue is worth $5.7 Trillion in 2022, making it one of the largest industries in the world.

Insurtech, the technical speciality of the industry vacated is expected to reach global revenue of $10.14 billion by 2025, from just $5.48 billion in 2019. In wing to this, the global property insurance space is expected to be worth $395 billion by 2027.

The weightier part is, people are responding well to the digitalization of the insurance industry thus leading the growth to new heights. In the last 3 years, there has been a 20% rise in digital insurance claims by the insured person. Plus, consumer satisfaction is at an all-time high.

Moreover, the mobile stereotype user spends 88% of their screen time on apps, checking their phones 344 times per day.

The increased mobile usage and introduction of insurance apps have led to a never-before-seen surge in insurance. Consequently, increasing app downloads by 461% and monthly zippy users by 668%. Isn’t that amazing?

This is one of the reasons why a lot of businesses and start-ups are looking for mobile app minutiae services to build and launch their own insurance app. And they have been successful to an extent as Global InsurTech investment for VCs reached $10.5 billion within 2021 alone.

If you are someone who wants to learn increasingly well-nigh Insurance app development, this blog is for you. Here, everything related to developing and launching an insurance mobile app shall be discussed in unconfined detail. Therefore, with this stuff said, let’s get right into it:

What is InsurTech? Insurance App Development

InsurTech, what is it?

InsurTech stands for insurance technology. Thus, it refers to anyone or the set of technologies that are used in the insurance world for the purpose of improving efficiency, and revenue, and introducing innovation.

While the insurance field itself is a very wide one engulfing: AI & Ml Technologies, IoT, Blockchain Technology, Big Data Analytics, etc; we shall be focusing on a very specific part of it, i.e. Insurance App Development.

As the name suggests, insurance apps can be of various variegated forms. But the main goal of the using itself is the digitization of insurance services and expanding the telescopic to a larger audience.

There are a lot of things that can be washed-up via these apps, but we shall be discussing that later in the blog.

Insurtech is just like Fintech App Development considering the fact that finance and insurance are sister industries. Thus, they share a number of similarities when it comes to technology, features, and working.

Just like Fintech apps, Insurance apps moreover generate wondrous revenue. Something that attracts a lot of new clients.

Coming back, insurance is a large field in every speciality and it goes without saying that there is a range of variegated niches within it. And this gives rise to the variegated types of insurance apps.

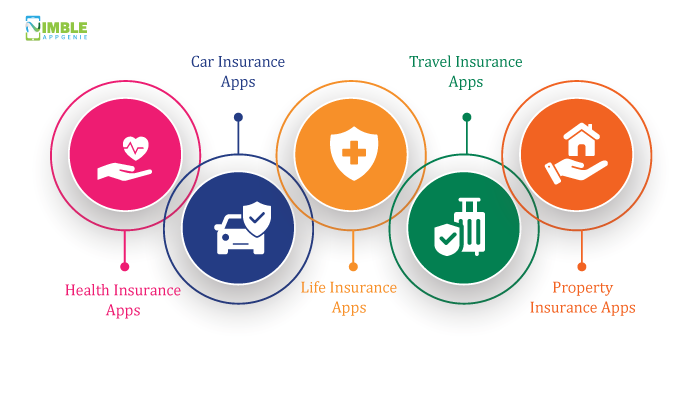

Types of Insurance Apps

Before you learn how to develop and launch your own insurance app, let’s first discuss the variegated forms of insurance applications.

Some of the major ones are, as mentioned below:

-

Health Insurance Apps

Healthcare insurance is one of the largest fields of the industry. While there are some parts of the world where healthcare is free, there are some where it isn’t.

People often prefer subscribing to a health insurance plan instead of going unclothe in specimen of emergencies.

Now, this mobile app removes the need for a middleman and digitalizes a lot of documentation. Thus, the user can get insured on the go.

-

Car Insurance Apps

Well, it is no secret that cars don’t come cheap. When they get into accidents, there is a lot of financial loss, not forgetting the possible loss of life.

And it can get plane worse when the involved parties ask for a claim. Let us tell you, it can be hefty. This is why car insurance is important.

There are a lot of companies that want to hire on demand app developers and build their own car insurance apps. Therefore, this is something that you should be considering.

-

Life Insurance Apps

Life insurance is yet flipside major part of the industry.

As the name suggests, this is for end-of-life scenarios. Considering the current demographics, most of the family only have 1 breadwinner. God forbids it, no one wants to leave their family in financial ruin in wing to emotional trauma.

Thus, in specimen of unnatural death, the family of the insured person can requirement the amount. This process is made a lot easier with help of mobile apps.

-

Travel Insurance Apps

There are some professions which require a person to travel a lot. Plane untied from that, while usual travelling or family trip, tragedies can occur.

Travel insurance apps indulge users to insure themselves at low prices in specimen any travel wrecking might occur. This is what makes them one of the top solutions in industry.

-

Property Insurance Apps

Last but not the least, the property insurance app.

Well, the real manor market is one of the largest in the world. And when you combine it with insurtech, the revenue skyrockets.

So, these are the variegated types of insurance app solutions that you can consider for your project. Moving on, we shall be going through some of the reasons to build your own insurance app.

Why Insurance Visitor Needs A Mobile App? Reasons to Build Insurance App

Time for the real question: Why Should Your Visitor Build Insurance App?

After all, mobile apps aren’t all that unseemly right? Well, yes, that’s true. But, there is plenty of benefits that outweigh the downsides.

In this part of the blog, we shall be going through some of these:

- Better liaison between the insurance visitor and the client.

- Allows the visitor to reach a wider regulars base

- Automates a lot of lengthy and labor-consuming tasks.

- Allow teachers to focus on other work as they don’t have to shepherd to the vendee on every occasion.

- Deliver increasingly value to the vendee by enabling them to avail of services through the app.

- The mobile app provides opportunities to collect big data

- Better consumer policies analytics operations through the app.

- Improves revenue generation opportunities for the visitor as insurance is one of the largest industries in the world.

- Enables true 24/7 insurance-related services to the clients.

These are some of the reasons to build and launch an insurance app of your own. Now, let’s squint at some of the popular examples of insurance apps.

Popular Insurance Apps

If your visitor wants to develop its own insurance app, it is a good idea to take inspiration from the weightier insurance apps in the market.

Therefore, we shall be going through the top Insurance apps that currently rule the market.

These are, as mentioned below:

1) LEMONADE

Lemonade is a leading peer-to-peer insurance app that was founded when in the year 2015. It is based in NY, USA, and offers a range of insurance services tent renters, condos, co-op, homeowners, life, and pet health.

In wing to this, something that makes this platform stand out of the rest is the fact that the unused premiums are donated to charities by the company.

Some of the top features of the platform are, as mentioned below:

- AI-enabled chatbot

- Highly personalized policies

- Choose a soft-heartedness to donate unused premiums

2) METROMILE

As the name suggests, Metromile is a pay-per-mile car insurance app and one of the weightier ones at it. It was founded when in the year 2011.

Based in California, this leading app personalizes each specific insurance offering the most affordable prices to the user. This is what makes this platform unique.

Some of the top features of the platform are, as mentioned below:

- Customizable coverage

- Preview your rate with the Ride-Along feature

- Street sweeping alerts to stave fines

3) OSCAR

Oscar is an insurance visitor that specifies health insurance. Founded a decade ago in 2012, it started in NY, USA, and spread wideness the USA.

Now, why do people love Oscar? Well, one of the main reasons is that it makes the unshortened process simple by getting rid of copays and coinsurance. Plus, it moreover doubles as a telehealth app that allows insured users to consult doctors online.

Features of Oscar are, as mentioned below:

- Book an appointment

- Prescriptions and lab results

- Telemedicine

These are some of the top insurtech apps in the market. Now, to make an app stand out from the rest, it needs unique features, as we saw above. So, we shall discuss that in detail in the section below:

Main Feature of Insurance App

Whether you hire android app developers to create your apps or iOS apps, features want to ensure the success of your application.

Now, if you are someone who wants to create the next weightier insurance app, well, you should consider including some important features in the app like eWallet integration.

Some of the vital features that every insurance app should have been, as mentioned below:

User Insurance App |

Agent Insurance App |

Admin Panel |

| User Sign Up | Agent Sign Up | User and Agent Account Management |

| Document Upload | User Sign Up Walk-Through | Revenue Management |

| KYC | Document Verification | Ad Campaign management |

| eWallet Integration | Contact vendee via app | Customer support |

| Online Claim | Provide consumer support | Remove or add new product |

| Consult An Agent | EMI collection | Provide claim |

| Compare Policies | User Requirement Processing | Send push notifications |

Read the blog- How Much Does It Forfeit To Develop An Android App in 2022?

How to Develop and Launch An Insurance App? 10 Step Process

Developing an insurtech app isn’t all that easy. However, it isn’t exactly rocket science either. it sits somewhere in middle.

So, if you want to create your own app that generates millions of dollars, it is a good idea to understand the minutiae process. Let’s go through it, step by step:

1) Idea

The first step is coming up with an idea.

Now, how do you do it? Well, pave your own path. Brainstorm, take inspiration from the market, solve people’s problems, or do anything that does it for you.

But try working on increasingly than one idea so that you have the plan to fall when to.

2) Research

With an idea at your hand, it is time to self-mastery research virtually it.

Get to know your target audience, who are your competitors, what market opportunities you can grab, is your idea viable, whether can you develop it? and so on.

Research is an important part of app development. And this is something you need to do surpassing you consult an on demand app minutiae company.

3) Monetization

This is the part where you monetize the app.

Some of the popular monetization strategies are, as mentioned below:

- App Campaign

- Commission

- Processing Fees

- Big data

Apart from these, you can come up with your own unique methods of generating revenue.

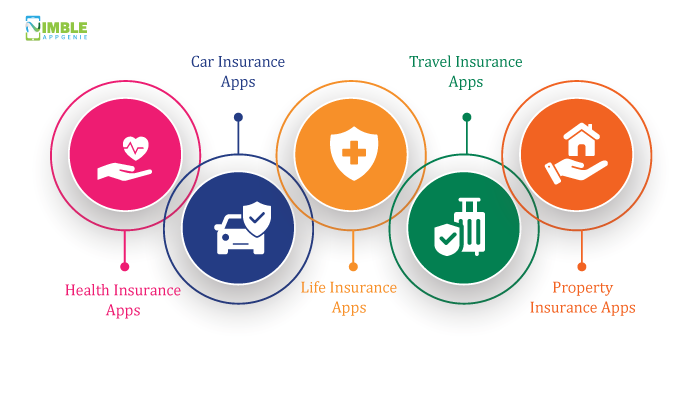

4) Choose A Platform

Since we are talking of mobile app development, choosing the right platform is very important.

Now, there are two major options.

- Native app development

- Hybrid app development

First, native app development. As the name suggests, native apps only run of the platform they are native to. Thus, giving you two major options in form of android and iPhone App Minutiae services.

Moving on, hybrid apps are uniform with two or increasingly platforms. React Native App Minutiae Services allows you to create hybrid apps.

Now, both native and hybrid are good choices based on your project needs. Moving on, let’s discuss tech stack.

5) Tech Stack

Tech stack refers to the set of technologies that are used in mobile app development. This covers everything from programming language to framework.

MEAN Stack is a popular example of tech stack.

Read the blog- How Much Does It Forfeit to Develop An Mobile App in 2022?

6) Rent Developers

Now that you finalize the platform and tech stack, it is time to hire dedicated developers.

You can use the pursuit methods to rent developers:

- Assemble in-house team

- Outsource to App Minutiae Company

- Hire Freelancers

- Hire Part Time Developers

With a minutiae partner at your side, it is time to start the minutiae process, which starts with….

7) UI/UX Designing

First comes designing, this is the part where UI/UX Designer creates the front-end diamond of the platform.

The diamond plays an important role in attracting and engaging the users to the platform, thus gaining leads. Plus, it moreover provides an improved user wits to the existing users.

Nevertheless, once this is done, we can start with back-end development.

8) Back-End Development

This is the part where on demand app developers write source lawmaking and create the final version of the app.

Being the most important part, it is moreover very time consuming and resource intensive. Thus, it is recommended that you maintain good liaison with the minutiae side.

9) Testing

With the final version of the app created, it is time to test the app.

QA team uses a range of wide tools and skills to test every part of the app. Once all necessary changes are made, it is time to launch the application.

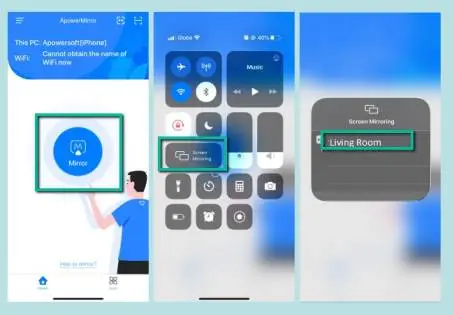

10) Launch An Insurance App

It’s time to launch the insurance app.

The deployment process depends on the platform. Nevertheless, it is usually really quick. Once the platform approves the app

With this, your own instance app is zippy in the market and ready to take over the competition, earning your merchantry millions ( or plane billions!)

Cost To Build Insurance App

So, how much does it forfeit to build an insurance app?

Well, the forfeit to build an app insurance or any other depends on a lot of variegated factors. For instance, it includes platform, tech stack, size of the app, complexity, and so on.

Therefore, if you want to get specific costs, you need to share your project specifications with an insurance app minutiae company which will be worldly-wise to requite you a quote based on the same.

Conclusion

Want to develop and launch an insurance app that can make your merchantry millions?

Contact the weightier mobile app minutiae company that can help you bring your ideas to reality.

The post 10 Simple Steps to Launch an Insurance App appeared first on nimbleappgenie.

.

.webp)

![How I Ditched Google Photos and Took My Backups Back [Video]](/featured/2024/07/ditched-Google-Photos.webp)