What if Meta launches a mobile app store?

This week, Microsoft supposed that it will launch a mobile games app store on both iOS and Android next year, should its vanquishment of Activision Blizzard be approved. As I noted in my piece on the topic, the scale of Microsoft’s opportunity in mobile gaming, through the combination of a defended storefront, its existing razzmatazz platform, and the portfolio of mobile content wideness Microsoft and King, is immense.

But Microsoft’s razzmatazz platform — which delivered $10BN in revenue on a trailing-twelve-month understructure as of last February and reached $12BN for the full timetable year in 2022 — is relatively small compared to the largest digital razzmatazz platforms, Alphabet and Meta, which generated $283BN and $113BN in razzmatazz revenues in 2022, respectively. If Microsoft sees mobile gaming as strategically valuable, and razzmatazz supports that thesis, then a natural question is: won’t Meta launch a mobile games store, too?

With its scaled razzmatazz infrastructure and its enviably massive roster of mobile gaming razzmatazz clients, Meta could unlock an enormous value of value by launching a mobile games app store on iOS and Android. The value proposition is obvious: Meta could powerfully sidestep the impairments of ATT if its razzmatazz clients’ mobile app install ads were directed to an app store that it owns.

In The coming war between Apple and Facebook, written in 2017, I hypothesized that Apple could fundamentally disrupt the digital razzmatazz ecosystem by restricting wangle to the Identifier for Advertisers, or the IDFA, which was formerly used to symbol installs to the ads that produced them on iOS. A short primer on attribution, from that piece:

As a gross oversimplification of the process of mobile install attribution: a developer routes app install ad wayfarers clicks to a third-party “attribution” service, which captures a lot of information well-nigh the user that clicked on an ad (including, if they’re using an iPhone or iPad, their device’s IDFA) surpassing forwarding the user to the towardly page in the App Store or Google Play. The user either downloads the app or doesn’t; if they do, when they unshut the app, that attribution service transmits, via an SDK that is implemented into the app, that same information when to its server. The server compares the data on the click and the install and determines whether the person that clicked the ad is the same person using the app now. If a match is made, that user is attributed to the click that was recorded and the wayfarers that click was generated by, and the developer can then estimate the expected revenue those users will generate over time (the users’ Lifetime Customer Values, or LTVs) and summate an ROI on those campaigns based on their costs.

Apple did ultimately regulate the use of the IDFA through its App Tracking Transparency (ATT) privacy policy, which indeed created severe consequences for many participants in the digital razzmatazz market. ATT prevents razzmatazz platforms like Meta’s from stuff worldly-wise to create behavioral profiles to use in razzmatazz targeting. As a policy, and not solely through withholding the IDFA in the specimen of ATT opt-out, ATT prevents identifiable data from stuff transmitted from an forerunner (for which it is first-party) to an ad platform, ad network, or razzmatazz measurement service (for which that data is third-party). This article provides increasingly verisimilitude on how ATT disrupts razzmatazz targeting and measurement.

But through a quirk of policy related to Apple’s definition of the concept of “tracking,” Apple is worldly-wise to utilize user-level install and purchase data processed by iTunes for razzmatazz targeting through its own ad network, which is primarily serviced within the App Store. Considering Apple processes app installs and in-app transactions through the App Store and through iTunes, and considering Apple’s definition of tracking relates to the comingling of first-party and third-party data for razzmatazz purposes, then its use of iTunes data for razzmatazz targeting in the App Store (and its other apps) is resulting with the restrictions imposed on developers through ATT.

Presumably, the same standard would wield to all app stores, including a theoretical app store operated by Meta. Apple is reportedly preparing the iOS environment to support multiple app stores, spurred by the Digital Markets Act (DMA) going into effect next year in the EU. The DMA, which imposes competitive restrictions on large, so-called “gatekeeper” platforms, will require digital platform operators to indulge the sideloading of apps.

It’s not well-spoken how volitional payments will be handled through enforcement of the DMA, and Apple has imposed a platform fee for volitional payments in the countries where it has unliable the practice. But plane if volitional app stores are prevented from processing payments, they could still symbol the app installs they generate to logged-in users. In Meta’s case, that knowledge could be used to target ads in its primary apps.

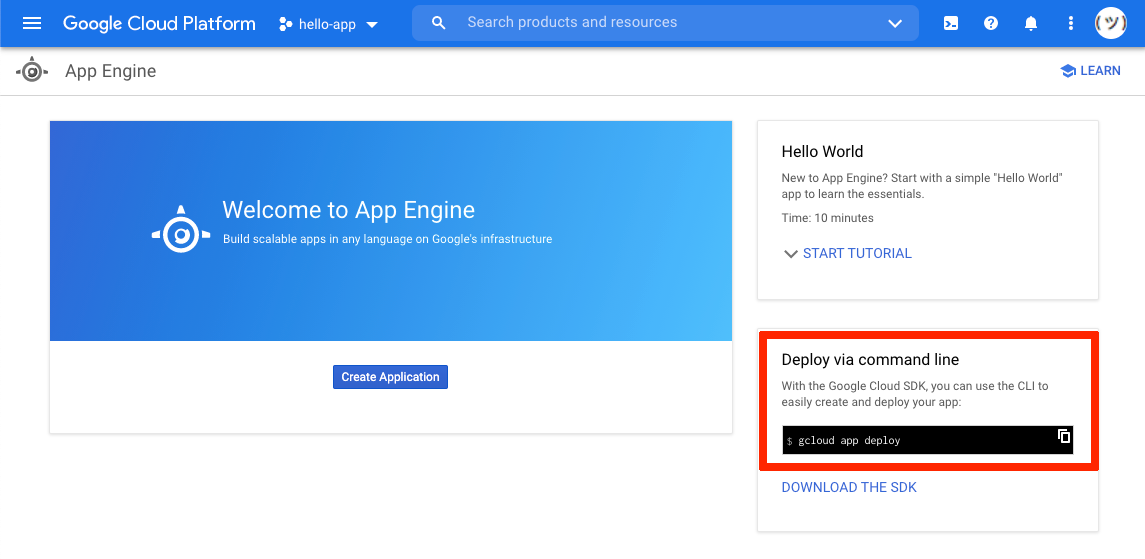

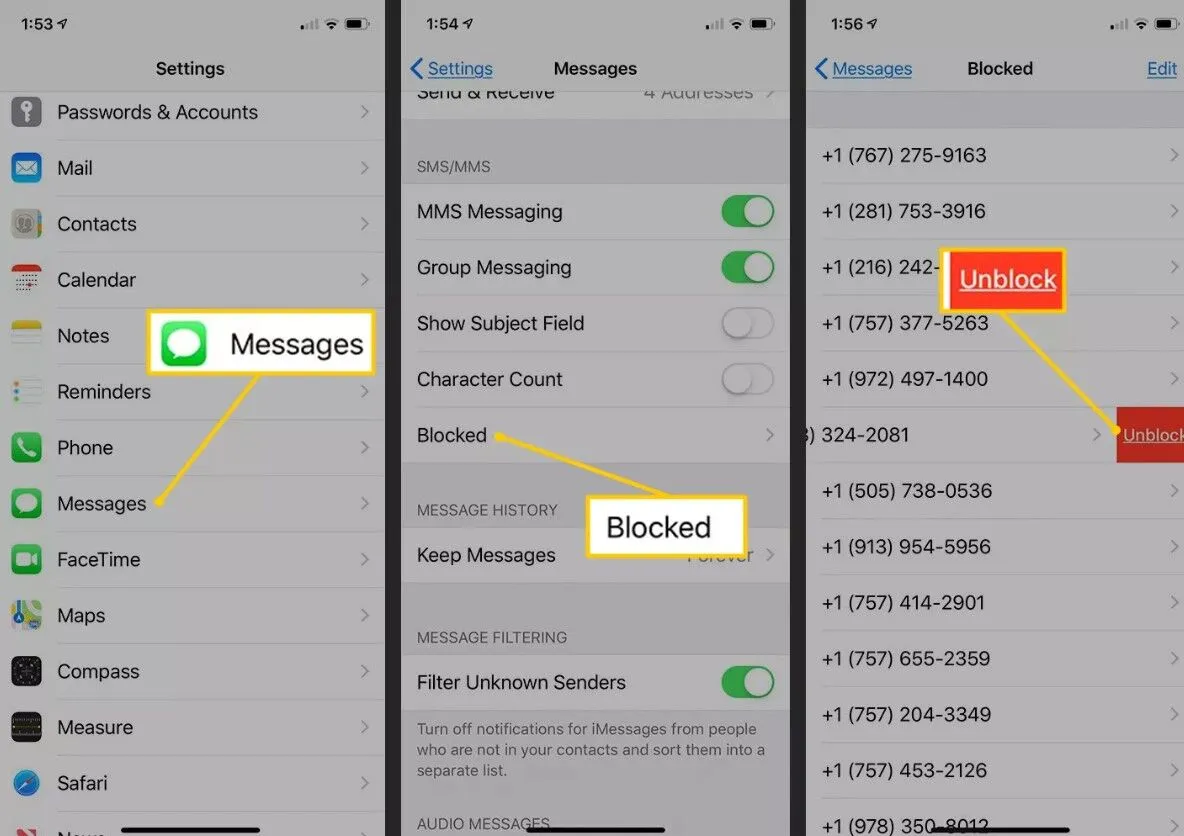

.

.jpg)